Nigeria’s foreign reserves have seen a net inflow of approximately $2.35 billion, strengthening the Central Bank’s reserves and contributing to stabilizing the naira.

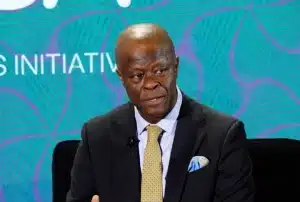

Naija News reports that this was revealed by the Minister of Finance and Coordinating Minister of the Economy, Wale Edun, during the Corporate Customers Forum held in Lagos on Thursday.

Edun explained that this net inflow has occurred consistently over the first seven months of the year, helping to boost Nigeria’s foreign exchange liquidity.

He went on to attribute the improvements in reserves and currency stability to the government’s proactive economic policies.

The minister also highlighted that Nigeria’s tax-to-GDP ratio remains low, at around 10%, while revenue-to-GDP stands at 15%, indicating that more efforts are required in these areas.

Edun called for increased spending on infrastructure and social safety nets to address these figures.

“We have relative currency stability. And of course, the all important margin of the rates. We’ve seen a gradual elimination of multiple exchange rate.

“We also have foreign exchange liquidity. The gross reserves are up. There have been a net inflow in the first seven months of this year of about $2.35 billion every month.

“On the fiscal side as well, government revenues are growing and the key to government revenue is not so much that government has revenue to compete with the private sector.

“It’s the fundamentals, the social and the key infrastructure spending. The social safety net spending. And historically, our figures are low. Our tax to GDP ratio is as low as 10%. Our revenue to GDP is also around 15%,” Edun said.

The post Nigeria’s Foreign Reserves Hit $2.35 Billion, Strengthening Naira Stability – Edun appeared first on Naija News.

Discover more from Smlblogtv

Subscribe to get the latest posts sent to your email.